This article presents an example of the new financial statement presentation (FASB ASU 2016-14) for a non-profit organization. The new statement requires firms to present the restricted asset information in a two column format rather than the existing three column format. The statement affects the face of the financial statements and the footnote disclosures and is effective for fiscal years ending 2018 and going forward.

After many years of discussion and revision, the Financial Accounting Standards Board (FASB) created Accounting Standards Update (ASU) 2016-14, Presentation of Financial Statements of Not-for-Profit Entities, released on August 18, 2016. Adoption of FASB ASU 2016-14 results in significant changes to financial reporting and disclosures for NFPs. FASB believes the update improves non-profits’ financial statements and provides more useful information to donors, grantors, creditors, and other financial statement users. The standard is effective for annual financial statements issued for fiscal years beginning after December 15, 2017 and for interim periods within fiscal years beginning after December 15, 2018 (AICPA, 2016).

What to expect after December 15, 2018 with FASB’s new reporting standard for non-profits?

The new guidance affects not-for-profit organizations and the users of their general purpose financial statements. Not-for-profit organizations affected include charities, foundations, colleges and universities, health care providers, religious organizations, trade associations, and cultural institutions, among others.

Specifically, the new guidance:

- Improves how not-for-profits communicate their financial performance and condition to stakeholders.

- Reduces costs and complexities in preparing financial statements.

- Provides relevant information about resources and changes in resources of not-for-profits by simplifying the face of financial statements and enhancing disclosures in the notes.

- Improves users’ assessments of liquidity, financial performance, resource availability to meet cash needs for general expenditures, service efforts, and ability to continue to provide services, and execution of stewardship responsibilities and other aspects of management performance.

What are the main provisions of the new FASB statement?

Accounting Standards Update (ASU) 2016-14 has five main provisions that change the existing non-profit financial statement reporting. These provisions are:

(1) Change in reporting of net assets. On the Statement of Financial Position, net assets are disclosed as either net assets with donor restrictions or net assets without donor restrictions. The terms temporarily restricted and permanently restricted are no longer used. On the Statement of Activities, the changes in net assets include only the two categories – net assets with donor restrictions or net assets without donor restrictions. Again, the use of temporarily restricted and permanently restricted terminology is no longer applicable.

(2) Change in Statement of Cash Flows presentation. Non-profits can continue to use the direct or indirect method for presenting Net Amount for Operating Cash Flows; however, the indirect method reconciliation is no longer required when using the direct method of presentation.

(3) Disclosure of investment returns. Non-profits need to disclose investment returns net of external and direct internal investment expenses. The disclosure of the netted expenses is no longer required.

(4) Changes in reporting long-lived assets. When restricted donations of cash and other assets for acquiring or constructing long-lived assets are released from their donor restrictions, the placed-in-service approach is used. The restriction release is reclassified from net assets with donor restrictions to net assets without donor restrictions at the beginning of the asset’s life (i.e., when placed in service). This approach replaces the current approach where the restrictions release is recognized over the estimated useful life of the acquired or constructed asset.

(5) Enhanced disclosures for the following items:

Amounts and purposes for self-imposed limits on use of resources as of the end of the fiscal period. These self-imposed limits include governing board designations, appropriations, and similar actions of management.

- Composition of net assets with donor restrictions at the end of the period, including how the restrictions affect the use of resources.

- Qualitative information on how the non-profit manages its liquid resources to meet cash needs for general expenditures within one year of the balance sheet date.

- Quantitative information, and additional qualitative information, that communicates the availability of financial assets at the balance sheet date to meet cash needs for general expenditures within one year of the balance sheet date.

- Amounts of expenses by both their natural classification and their functional classification, located in one place – face of financial statements or disclosures.

- Methods used to allocate costs among program and support functions.

- Required disclosures for underwater endowment funds.

Example financial statement changes

The remainder of this article demonstrates the specific changes to the financial statement presentations of non-profits. We use a Michigan local non-profit, Interlochen Center for the Arts, to describe the FASB changes. The five areas include: (1) net asset classification, (2) cash flow statement, (3) investment returns, (4) long-lived asset approach for donor restriction release, and (5) enhanced disclosures.

(1) Net asset classification: Classification of net assets into two categories aligns the accounting standards with the current legal requirements on maintaining donor-restricted endowment funds (Thomas, 2016). The following illustration shows the change in net asset classification:

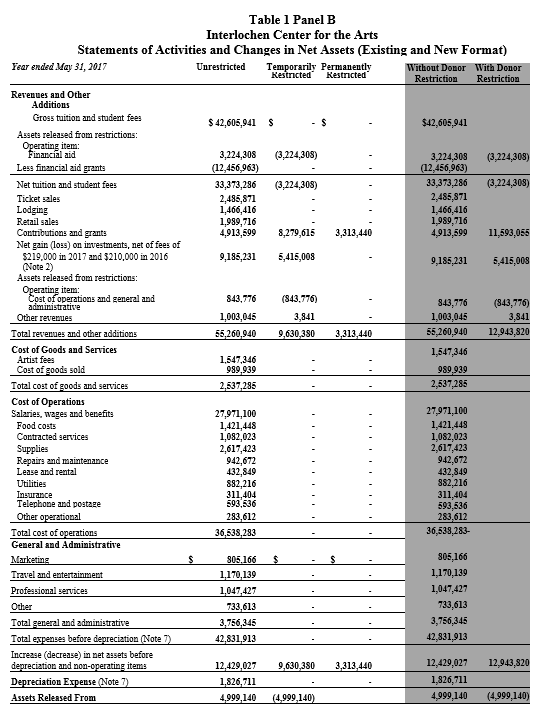

For Interlochen Center for the Arts, this change in net assets affects its Statement of Financial Position, Statements of Activities and Changes in Net Assets, and footnote disclosures. The following illustrations show the existing and revised net asset presentations for the affected statements and disclosures.

In addition to the financial statements, Interlochen Center for the Arts have disclosures affected by the net asset classification change. The following illustrations show the changes in the disclosures.

Footnote 1: Net Asset Classifications – Existing Definitions

Unrestricted Net Assets: Unrestricted net assets are used to account for transactions related to the fine arts and academic programs as determined by the Board of Trustees and carried out by the administration.

Temporarily Restricted Net Assets: Temporarily restricted net assets are used to account for transactions related to scholarships, donor-restricted contributions related to fine arts and academic programs, income from endowment contributions which can only be expended as stipulated by the donor, and contributions and grants that are unexpended related to land, building and equipment.

Permanently Restricted Net Assets: Endowment funds result from contributed assets which have donor-imposed restrictions which do not expire. The principal of these funds is permanently maintained.

Revenues are reported as increases in unrestricted net assets unless use of the related assets is limited by donor-imposed restrictions. Expirations of temporary restrictions on net assets (i.e., the donor-stipulated purpose has been fulfilled and/or the stipulated time period has elapsed) are reported as reclassifications between the applicable classes of net assets.

Net Asset Classifications – New Definitions

Net Assets With Donor Restrictions: The net assets subject to donor-imposed restrictions include scholarships, donor-restricted contributions related to fine arts and academic programs, income from endowment contributions which can only be expended as stipulated by the donor, contributions and grants that are unexpended related to land, building, and equipment, and endowment funds from contributed assets which have donor-imposed restrictions.

Net Assets Without Donor Restrictions: The net assets not subject to donor-imposed restrictions, including transactions related to fine arts and academic programs as determined by the Board of Trustees and carried out by the administration. Revenues are reported as increases in net assets without donor restrictions unless the use of the related assets are limited by donor-imposed restrictions.

Footnote 10: Endowments

Just like the financial statements, the footnotes need to adjust from the three column format to the two column format for reporting endowment assets. Table 2, Panels A and B show the changes necessary for footnote 10, Endowments. The composition of endowment net assets by type of fund as of May 31, 2017 is as follows:

The changes in endowment net assets for the fiscal year ended May 31, 2016 is as follows:

In addition to the changes to the face of the financial statements and footnote disclosures, Interlochen Center for the Arts needs to adjust the presentation of its supplemental information – schedule of activities – to reflect the change to Without Donor Restrictions and With Donor Restriction categories.

(2) Cash flow statement: At present, non-profits can use either the direct or the indirect method for net cash flows from operating activities; however, an indirect reconciliation was necessary if the non-profit elected to use the direct method. Under the new statement, the reconciliation is no longer required. This change may encourage more organizations to choose the direct method. Interlochen Center for the Arts currently uses the indirect method, so no change in reporting is anticipated for this organization.

(3) Investment return: Currently, non-profits are required to disclose all investment expenses and display the investment return components in the endowment net assets roll-forward. The new statement allows non-profits to net direct internal and external investments expenses against investment returns without disclosing the details of the netted expenses. Similarly, entities are permitted, but not required, to disclose netted internal salaries and benefits and they are no longer required to display the investment return components in the endowment net assets roll-forward (Spinelli, 2016).

Interlochen Center for the Arts discloses its investment returns in footnotes 2 Investments and 10 Endowments. The financial statements do not include a net assets roll-forward, thus both disclosures already net investment returns with investment expenses. Therefore, no significant change in disclosure is required for Interlochen Center for the Arts.

(4) Long-lived assets released from restrictions: Currently, when donor restricted contributions for long-lived assets are released from restrictions, the non-profit has the option to recognize the release over the estimated useful life of the acquired or constructed asset. The new statement removes this option, requiring the release from restrictions to follow the placed-in-service approach, where the release is transferred from restriction at the date the asset is acquired. Interlochen Center for the Arts does not specify in its disclosures whether it is using the current option – recognize release over the life of the asset – or the placed-in-service option. However, it will need to use the place-in-service option for future reporting periods.

(5) Enhanced disclosures: Accounting Standards Update (ASU) 2016-14 lists several items requiring more disclosures. The following briefly summarizes these required disclosures.

- The ASU requires non-profits to disclose the amounts and purposes of governing board designations, appropriations, and similar self-imposed limits on the use of resources without donor restrictions as of the end of the fiscal period. The financial statements and disclosures for Interlochen Center for the Arts does not currently include this disclosure.

- The ASU requires non-profits to disclose the composition of net assets with donor restrictions as of the end of the fiscal period, as well as how the restrictions affect the use of resources. Interlochen Center for the Arts currently discloses the composition of net assets temporarily and permanently restricted by fund in its Supplementary Information. However, it does not disclose the effects the restrictions have on use of resources. The Center will most likely add new disclosures in the notes to the financial statement to address this required information.

- Available resources and liquidity were not previously required disclosures. The ASU now requires both quantitative and qualitative information be disclosed. Quantitative information can be disclosed either on the face of the statement of financial position or in the notes. The qualitative information is disclosed in the notes to the financial statements. The information in the notes must communicate how the non-profit manages its liquid resources available to meet cash needs for general expenditures within one year of the balance sheet. Since this is a new requirement, Interlochen Center for the Arts does not currently disclose this information but will need to do so in future financial statement reporting. The proprietary nature of this information does not allow us to provide an example of this disclosure for Interlochen Center for the Arts. However, here is an example disclosure from ASU 2016-14:

- Most non-profits currently provide a generic disclosure on allocation of costs. However, for the detail necessary to report the expenses by function and nature, non-profits should consider making enhancements to their current chart of accounts to assist in generating a statement of functional expenses statement directly from the general ledger with minimal edits outside of the system (Thomas, 2016). Interlocken Center for the Arts currently discloses expenses by function in footnote 7.

7. Functional Expenses

The Center’s department classification is the basis for allocating costs among the functional classifications. The method used is considered reasonable; however, other methods could produce different results.

Expenses incurred in functional areas for the years ended May 31, 2017 and 2016 include allocations of certain common expenses and are as follows:

Per ASU 2016-14, the footnote for disclosing expenses by function and nature for Interlochen Center for the Arts for 2017 could be as follows.

*Due to proprietary information, the table cannot be completed in its entirety.

This disclosure must also include the methods used to allocate costs to programs and support services.

- Interlochen Center for the Arts currently discloses underwater endowments in its footnote 10, Endowments. ASU 2016-14 requires more detail than just the total amount of deficiency. For example, the $213,431 deficiencies reported in unrestricted net assets for 2017 would now include the number of endowment funds, the original gift values, the current fair values, and the deficiency amounts.

Interlochen Center for the Arts currently discloses much information, but will need to re-format and include more details under ASU 2016-14 beginning fiscal year end 2018. The new statement requirements can be found on the Financial Accounting Standards Board website.

==========

References:

Accounting Standards Update (2016). No. 2016-14, Not-for-Profit Entities (Topic 958), Presentation of Financial Statements of Not-for-Profit Entities, Financial Accounting Standards Board. Information retrieve date is January 12, 2018 and from: http://www.fasb.org/jsp/FASB/FASBContent_C/CompletedProjectPage&cid=1176168381520

AICPA (2016). FASB’s New Standard Aims to Improve Not-for-Profit Financial Reporting. Information retrieved date is January 12, 2018 and from: http://www.aicpa.org/interestareas/notforprofit/resources/financialaccounting/new-standard-aims-to-improve-not-for-profit-financial-reporting.html

Economic Benefit of Michigan’s Nonprofit Sector (2016). Information retrieved date is January 12, 2018 and from:

http://www.mnaonline.org/research-publications/economic-benefits-of-michigan-s-nonprofit-sector, and https://www.mnaonline.org/interactive-economic-benefits-dashboard.

Gulati-Partee, Gita (2001). A Primer on Nonprofit Organizations, Popular Government, School of Government, University of North Carolina at Chapel Hill. . Information retrieve date is November 21, 2017 and from: http://uncnonprofit.web.unc.edu/files/2011/08/Nonprofit-Primer-Gulati.pdf

Interlochen Center for the Arts, Financial Statements (2017). Information retrieved date is January 29, 2018 and from:

http://www.interlochen.org/sites/default/files/ICA_Financial_Statements_FY2017.PDF

Key differences between Non-Government Organizations (NGO) and Non-Profit Organizations (NPO), Carnegie Mellon University. Information retrieve date is January 11, 2018 and from:

http://www.cmu.edu/career/documents/industry-guides/NGOs%20and%20NPOs.pdf

Legal Information Institute (LII), Cornell Law School, Cornell University. Information retrieve date is January 12, 2018 and from: http://www.law.cornell.edu/wex/non-profit_organizations

McKeever, Brice (2015). The Nonprofit Sector in Brief 2015: Public Charities, Giving, and Volunteering. Information retrieve date is January 12, 2018 and from: http://www.urban.org/research/publication/nonprofit-sector-brief-2015-public-charities-giving-and-volunteering

Mullen, Carolyn, Ring, John, & Klumpp, Lee (2017). BDO Knowledge (Webinar Series), Implementation Issues Related to ASU 2016-14, Financial Statements of Not-for-Profit Entities. Information retrieved date is January 16, 2018 and from:

http://www.bdo.com/BDO/media/Misc-Documents/NFP-Presentation-Standard_Implementatio-Panel-Discussion_Final.pdf

Quick Facts About Nonprofits. Information retrieved date is January 12, 2018 and from: http://nccs.urban.org/data-statistics/quick-facts-about-nonprofits

Reck, Jacqueline L., & Lowensohn, Sunanne L. (2016). Accounting for Governmental & Nonprofit Entities, 17ed., Chapter 1, Sources of Financial Reporting Standard, 4-5. McGraw-Hill Education, New York, NY.

Spinelli, Connie L. (2016). In Depth: New Standard on NFP Financial Statement Presentation. Information retrieved date is January 18, 2018 and from:

http://www.bkd.com/docs/pdf/In-Depth-New-Standard-on-NFP-Financial-Statement-Presentation.pdf

Thomas, Sibi (2016). FASB Looks at Nonprofits. Information retrieved date is January 18, 2018 and from: http://www.accountingtoday.com/news/fasb-looks-at-nonprofits

Tiso, Jacqueline (2017). A Practical Guide to the FASB ASU 2016-14 for Nonprofits. Information retrieved date is January 18, 2018 and from: http://jmtconsulting.com/a-practical-guide-to-the-fasb-asu-2016-14-for-nonprofits/

Whitaker, Celia (2005). Bridging the Book-Tax Accounting Gap, The Yale Law Journal, New Haven, CT. Information retrieved date is January 8, 2018 and from:

https://www.yalelawjournal.org/pdf/384_582efstp.pdf

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs